The Evolution of Billing Software

The journey of billing software began with basic spreadsheet tools and manual processes. As businesses expanded, they needed specialized solutions to address growing volumes and complexity. By the early 2000s, dedicated billing apps emerged, bringing features like automated invoice generation, electronic payment processing, and robust reporting.

With the rise of cloud-based solutions, billing apps became even more accessible and scalable. SaaS (Software as a Service) models made it possible for businesses to manage their invoicing from anywhere with an internet connection, and mobile-friendly options extended these capabilities even further. Billing apps have transformed from basic tools into comprehensive solutions that drive efficiency, cut costs, and enhance the customer experience.

Transforming Financial Operations Through Automation

One of the biggest impacts of billing apps is the automation of time-consuming tasks, allowing finance teams to focus on strategic responsibilities.

- Reduced Errors: Automated calculations and data entry minimize human errors, ensuring invoices are accurate and financial records stay consistent.

- Time and Cost Efficiency: Billing apps streamline processes, allowing for quicker invoicing, fewer delays, and reduced labor costs. Businesses can redirect their teams toward revenue-generating activities.

- Optimized Cash Flow: With features like recurring billing, automated reminders, and quick payment options, businesses experience faster receivables and improved cash flow.

These advantages underscore how automation drives productivity and improves cash management, creating ripple effects that positively impact the entire organization.

Enhanced Accessibility and Mobility

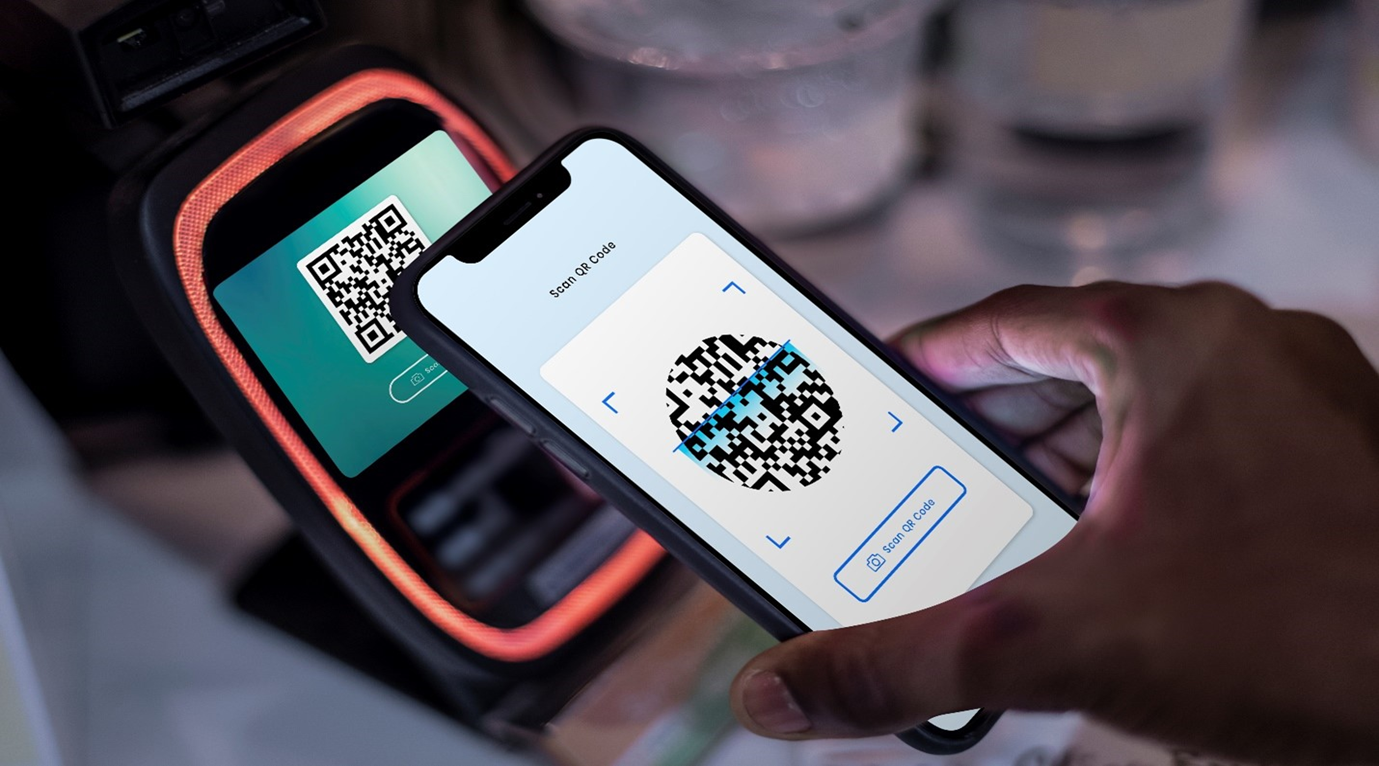

Billing apps have transformed the way businesses manage finances by enabling remote access and mobile functionality:

- Cloud Access: Cloud-based billing apps allow teams to access financial data securely from any device, ensuring real-time data synchronization and reducing downtime.

- Mobile Apps: With mobile billing solutions, team members can manage invoicing and payments while on the go, making it easier to stay on top of finances.

- Collaborative Tools: Many billing apps now support multiple users, enabling seamless collaboration among team members and allowing distributed teams to work efficiently.

Did you know? Over 70% of small businesses now use mobile devices for invoicing and financial management, highlighting the demand for flexible billing solutions.

With cloud and mobile access, billing apps allow businesses to adapt to remote and hybrid work setups, enhancing productivity and ensuring that team members have the information they need wherever they are.

Seamless Integration with Other Business Systems

Modern billing apps aren’t isolated—they work with a variety of other business tools, creating a more integrated financial ecosystem.

- Accounting Software Integration: By syncing with popular accounting software like QuickBooks and Xero, billing apps provide a holistic view of business finances.

- Customer Relationship Management (CRM) Systems: Integration with CRM software allows billing apps to link financial and customer data, improving insight into client payment histories and streamlining follow-up processes.

- Enterprise Resource Planning (ERP) Integration: For larger companies, billing apps can connect with ERP systems, enabling more efficient coordination across finance, operations, and supply chain management.

Integration Benefits:

1.Reduces manual data entry, which saves time and cuts down on potential errors.

2. Provides a unified view of customer accounts and finances.

3. Enhances customer service with quicker and more efficient communication.

Integrations simplify workflows, increase visibility across the organization, and allow businesses to make better-informed financial decisions.

Ready to streamline invoicing and improve cash flow with the latest billing app technology?

Talk To Our Experts

Prioritizing Security and Compliance

As digital billing involves sensitive financial data, security and regulatory compliance are critical elements in billing software development.

- Data Protection: Quality billing apps utilize encryption, secure servers, and regular data backups to safeguard sensitive information.

- Compliance Standards: Robust billing software adheres to industry regulations like GDPR, HIPAA, and PCI DSS, ensuring that businesses meet compliance requirements.

- Fraud Prevention: With audit trails and user permissions, billing apps help reduce the risk of unauthorized access and fraud.

Companies that invest in secure billing solutions report a 22% decrease in financial fraud incidents, emphasizing the value of reliable, compliant software.

High standards in security and compliance allow businesses to handle sensitive financial data with confidence, reducing liability risks and enhancing credibility.

Emerging Features and Future Trends in Billing Software

Billing software continues to evolve to meet new demands and integrate cutting-edge technologies.

- Artificial Intelligence and Machine Learning: AI-driven billing apps can predict cash flow trends, detect anomalies, and automate repetitive tasks.

- Blockchain Technology: With its secure, transparent structure, blockchain can enhance security and accuracy in financial transactions.

- Subscription and Recurring Billing Models: As subscription-based businesses grow, billing apps are increasingly catering to recurring revenue models with automated billing.

- Multi-Currency Support for Global Operations: With the rise of international business, billing apps that handle multiple currencies and global compliance standards are becoming essential.

- Customization and Personalization: Tailoring invoices, payment reminders, and customer communications allow businesses to align billing with their brand identity and customer expectations.

Fun Fact: The market for AI in billing software is expected to grow by 40% annually through 2028, indicating strong demand for adaptive, intelligent billing solutions.

These innovations cater to a diverse range of business needs and elevate billing from a basic function to a strategic advantage.

Conclusion

Billing apps have become an indispensable tool for businesses of all sizes, helping to streamline invoicing, improve cash flow, and elevate the overall customer experience. By adopting the right billing app, companies can enhance their financial efficiency, reduce costs, and gain greater control over their financial operations.

At Neuronimbus, we’re passionate about helping businesses explore the right solutions for their unique needs. Whether you’re looking to streamline your invoicing process or integrate advanced features, our expertise in billing software development can guide you toward a solution that meets your goals and enhances your financial management. Let’s talk about how we can drive financial innovation together.